Use these links to rapidly review the document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

☐

Preliminary Proxy Statement

☐

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒

Definitive Proxy Statement

☐

Definitive Additional Materials

☐

Soliciting Material under §240.14a-12

Dollar General Corporation

| | |

Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

(Name of Registrant as Specified in Its Charter) |

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

| | | | |

Dollar General Corporation |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies:

|

| | (2) | | Aggregate number of securities to which transaction applies:

|

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | (4) | | Proposed maximum aggregate value of transaction:

|

| | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | (2) | | Form, Schedule or Registration Statement No.:

|

| | (3) | | Filing Party:

|

| | (4) | | Date Filed:

|

Table of Contents

Person(s) Filing Proxy Statement, if other than the Registrant)Payment of Filing Fee (Check all boxes that apply): ☒

No fee required

☐

Fee paid previously with preliminary materials

☐

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

| | |

|

| |

Dollar General Corporation

100 Mission Ridge

Goodlettsville, Tennessee 37072 |

|

Dear Fellow Shareholder:

The 2016

DEAR FELLOW SHAREHOLDERS,

On behalf of the Board of Directors, we look forward to welcoming you to the 2024 Annual Meeting of Shareholders of Dollar General Corporation, which will be held on Wednesday, May 25, 2016,29, 2024, at 9:00 a.m., Central Time, at Goodlettsville City Hall Auditorium, 105 South Main Street,Dollar General Corporation, Turner One Building, 100 Mission Ridge, Goodlettsville, Tennessee. All

We would like to thank you for your continued investment in Dollar General. It has been my privilege to serve as Chairman of the Board over the last 8 years, and I look forward to the year ahead.

Our objectives and actions are informed by your feedback, and we appreciate the opportunity to speak with many of you over the past year. In 2023, we engaged with shareholders comprising approximately 55% of shares outstanding as part of our focused annual shareholder outreach program. As Chairman, I led the engagement with shareholders representing approximately 38% of shares outstanding. The information we received from shareholders helped to inform decisions regarding the enhanced disclosures in this Proxy Statement and in our Serving Others report for 2023, as well as our recently published report on the findings of the employee safety and well-being audit. Below are several areas of particular importance to the Board that we discussed with our shareholders this past year:

•

CEO Succession. CEO succession is a key component of our long-term business strategy and is a top priority for the Board. On October 12, 2023, we announced the re-appointment of Todd Vasos, our former CEO and existing Board member, as our CEO. Todd’s deep expertise and familiarity with Dollar General continues to be an asset to our Company, and the strong relationships and respect he has built with the investment community, vendors, our executive team and the broader employee base over his tenure have supported a seamless transition. We are confident Todd is the right leader to refocus our Company’s strategic direction and priorities to stabilize the business.

•

Workplace Safety. Dollar General has a long-standing commitment to addressing matters that can affect our workplace experience, including employee safety and well-being. Our safety program includes standardized policies and procedures, training, and other proactive measures combined with monitoring and use of data analytics to drive preventative strategies and evolve employee safety strategies and initiatives. At the 2023 Annual Meeting of Shareholders, a majority of our shareholders voted in favor of a shareholder proposal requesting an employee safety and well-being audit. At the direction of our General Counsel and with oversight by the Board, we subsequently engaged an independent third party to conduct the audit and published a related report in April 2024. For further details, please refer to our Report on Audit of Dollar General Safety Policies and Practices published at https://www.dollargeneral.com/about-us/corporate-social-responsibility.

•

Board Composition. Our Board represents a diversity of experience, backgrounds, viewpoints, tenure, age, gender, and race. We have robust corporate governance measures to foster shareholder participation and Board responsiveness and accountability, including strong director refreshment and evaluation practices. Approximately 38% of our independent directors have joined the Board within the last five years, including most recently the appointment of David Rowland on August 5, 2023. David is the former Executive Chairman of Accenture, where his career spanned nearly four decades. He brings to our Board a deep knowledge of the global marketplace and vast experience in finance, operations, strategy and risk management.

We would like to thank our shareholders, employees, customers, and business partners for their continued support and contributions to Dollar General’s success. We remain confident in our path forward under Todd’s leadership and in our ability to continue to build momentum with the Board’s active oversight.

| | | | | SINCERELY, MICHAEL M. CALBERT CHAIRMAN OF THE BOARD

APRIL 5, 2024 | |

We will begin mailing to shareholders printed copies of this document and the form of proxy or the Notice of Internet Availability on or about April 5, 2024.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| | | | | | | | | | | |

| | DATE | | | | TIME | | | | LOCATION | |

| | | | | | | | | | | |

| | Wednesday,

May 29, 2024 | | | | 9:00 a.m. Central Time | | | | Dollar General Corporation, Turner One Building

100 Mission Ridge

Goodlettsville, Tennessee | |

| | | | | | | | | | | |

ITEMS OF BUSINESS:

•

To elect as directors the nine nominees listed in the Proxy Statement

•

To hold an advisory vote to approve our named executive officer compensation as disclosed in the Proxy Statement

•

To ratify the appointment of our independent registered public accounting firm for fiscal 2024

•

To vote upon a shareholder proposal, as described in the Proxy Statement, if properly presented at the annual meeting

•

To transact any other business that may properly come before the annual meeting and any adjournments of that meeting

WHO MAY VOTE:

Shareholders of record at the close of business on March

17, 2016 are invited to attend the annual meeting. For security reasons, however, to gain admission to the meeting you may be required to present photo identification and comply with other security measures. At this year's meeting, you will have an opportunity to vote on the matters described in our accompanying Notice of Annual Meeting of Shareholders and Proxy Statement. Our 2015 Annual Report and our Annual Report on Form 10-K for the fiscal year ended January 29, 2016 also accompany this letter.

Your interest in Dollar General and your vote are very important to us. We encourage you to read the Proxy Statement and vote your proxy as soon as possible so your vote can be represented at the annual meeting. You may vote your proxy via the Internet or telephone, or if you received a paper copy of the proxy materials by mail, you may vote by mail by completing and returning a proxy card.

On behalf of the Board of Directors, thank you for your continued support of Dollar General.

| | |

|

|

Sincerely, |

|

|

/s/ Michael M. Calbert |

|

|

Michael M. Calbert

Chairman of the Board |

April 8, 2016

Table of Contents

| | |

|

| | Dollar General Corporation

100 Mission Ridge

Goodlettsville, Tennessee 37072 |

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| | | | |

DATE: | | Wednesday, May 25, 2016 |

TIME: |

|

9:00 a.m., Central Time |

PLACE: |

|

Goodlettsville City Hall Auditorium

105 South Main Street

Goodlettsville, Tennessee |

ITEMS OF BUSINESS: |

|

1) |

|

To elect as directors the 8 nominees listed in the proxy statement |

|

|

2) |

|

To ratify the appointment of the independent registered public accounting firm for fiscal 2016 |

|

|

3) |

|

To transact any other business that may properly come before the annual meeting and any adjournments of that meeting |

WHO MAY VOTE: |

|

Shareholders of record at the close of business on March 17, 2016 |

|

|

By Order of the Board of Directors, | |

|

|

/s/ | | | | |

| | Goodlettsville, Tennessee

April 5, 2024 | | | Christine L. Connolly

Corporate Secretary | |

| | | Please vote your proxy as soon as possible even if you expect to attend the annual meeting in person. You may vote your proxy via the internet or by phone by following the instructions on the Notice of Internet Availability or proxy card, or if you received a paper copy of these proxy materials by mail, you may vote by mail by completing and returning the enclosed proxy card in the enclosed reply envelope. No postage is necessary if the proxy is mailed within the United States. You may revoke your proxy by following the instructions listed on page 2 of the Proxy Statement. | | |

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in the proxy statement or about Dollar General. This summary does not contain all of the information that you should consider, and you should review all of the information contained in the proxy statement before voting.

WHO WE ARE

We are today’s neighborhood general store, serving the needs of our customers by providing convenience, value and service—Every day!

(1)

As of March 1, 2024.

![[MISSING IMAGE: lg_dollargeneral-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044304/lg_dollargeneral-pn.jpg) 2024 Proxy Statement

2024 Proxy Statement

BOARD OF DIRECTORS COMPOSITION (pp. 5 - 9, 14 - 15 and 19)

2024 Proxy Statement ![[MISSING IMAGE: lg_dollargeneral-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044304/lg_dollargeneral-pn.jpg)

BOARD OF DIRECTORS GROUP DIVERSITY (pp. 4 - 9)

BOARD-LEVEL STRATEGY AND RISK OVERSIGHT (pp. 12 - 15)

Our Board of Directors actively oversees our corporate strategy and related risks and further coordinates risk oversight with its three fully independent committees, each with a different set of responsibilities:

| | | | | | | | | | | |

Goodlettsville, Tennessee

April 8, 2016 |

|

Christine L. Connolly

Corporate SecretaryAUDIT COMMITTEE Oversees financial reporting matters and enterprise risk management, including cybersecurity | | | | COMPENSATION AND HUMAN CAPITAL MANAGEMENT COMMITTEE Oversees significant human capital management matters, including diversity and inclusion; employee recruitment, retention and engagement; labor matters; and compensation | | | | NOMINATING, GOVERNANCE AND CORPORATE RESPONSIBILITY COMMITTEE Oversees corporate governance and significant corporate social responsibility and sustainability matters | |

| | | | | | | | | | | |

SHAREHOLDER ENGAGEMENT (pp. 11 - 12)

Please vote your proxy as soon as possible even if you expect to attendOur Board of Directors appreciates and proactively seeks the annual meeting in person. You may vote your proxy via the Internet or by phone by following the instructions on the noticeviewpoints of internet availability or proxy card, or if you received a paper copy of these proxy materials by mail, you may vote by mail by completing and returning the enclosed proxy cardour shareholders. Our focused outreach in the enclosed reply envelope. No postage is necessary iffall of 2023 encompassed a broad base of shareholders and discussion topics and helped inform our approach to the proxy is mailed withinsafety and well-being audit and report that shareholders requested at the United States. You may revoke your proxy by following the instructions listed on page 3 of the proxy statement.

Table of Contents

DOLLAR GENERAL CORPORATION

Proxy Statement for

20162023 Annual Meeting of Shareholders,

as well as various other disclosure enhancements in this proxy statement and in our Serving Others report for 2023.

![[MISSING IMAGE: pc_invited-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044304/pc_invited-pn.jpg)

![[MISSING IMAGE: lg_dollargeneral-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044304/lg_dollargeneral-pn.jpg) 2024 Proxy Statement

2024 Proxy Statement

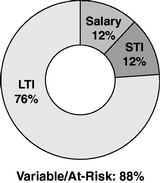

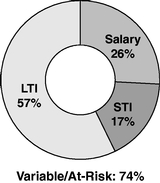

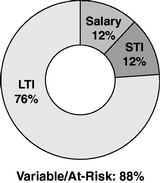

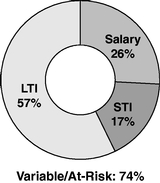

PAY FOR PERFORMANCE (pp. 21 - 31)

The primary elements of our 2023 annual executive compensation program are summarized in the chart below and reflect significant alignment with our shareholders’ interests.

| | | |

General Information

Consistent with our philosophy,

and as illustrated to the right, a

significant portion of annualized

total target compensation for

our named executive officers in

2023 was variable/at-risk as a

result of being performance-based (dependent on our financial performance, linked to changes in our stock price, or both). | | 1 | The most recent shareholder advisory vote on our named executive officer compensation was held on May 31, 2023. Excluding abstentions and broker non-votes, 90.9% of total votes were cast in support of the program. | |

2024 Proxy Statement ![[MISSING IMAGE: lg_dollargeneral-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044304/lg_dollargeneral-pn.jpg)

VOTING MATTERS (pp. 1 - 10, 54, 59 and 60 - 62)

Voting Matters

| 2024 PROPOSALS | | 2 | Board

Recommendation | |

| Proposal 1:

Election of Directors | | 5 | For | |

Corporate Governance

| Proposal 2:

Advisory Vote to Approve Named Executive Officer Compensation | | 11 | For | |

Director Compensation

| Proposal 3:

Ratification of Appointment of Auditors | | 16 | For | |

Director Independence

| Proposal 4:

Shareholder Proposal | | 19 | Against | |

HOW TO VOTE (p. 2)

Transactions with Management and Others

| | 21 |

Executive Compensation

| | 22 | | | | | | | | | | |

| | MAIL | | | | PHONE | | | | INTERNET | | | | IN PERSON | |

| | | | | | | | | | | | | | | |

| | Complete, sign,

date and mail your

proxy card or

voting instruction form | | | | 1-800-690-6903 | | | | www.proxyvote.com | | | | May 29, 2024

9:00 a.m., CT

Dollar General Corporation

Turner One Building

100 Mission Ridge

Goodlettsville, Tennessee | |

| | | | | | | | | | | | | | | |

![[MISSING IMAGE: lg_dollargeneral-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044304/lg_dollargeneral-pn.jpg) 2024 Proxy Statement

2024 Proxy Statement

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | Compensation Committee Report | | | | |

| | Summary Compensation Table | | | | |

| | Grants of Plan-Based Awards in Fiscal 2015 2023 | | | | |

| | Outstanding Equity Awards at 20152023 Fiscal

Year-End | | | | |

| | Option Exercises and Stock Vested During

Fiscal 2015 2023 | | | | |

| | Pension Benefits Fiscal 2015 2023 | | | | |

| | Nonqualified Deferred Compensation Fiscal 2015

2023 | | | | |

| | Potential Payments uponUpon Termination or Change in Control | | | | |

| | | | | | |

| | Compensation Committee Interlocks and Insider Participation | | | | |

| | Compensation Risk Considerations | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | Security Ownership of Officers and

Directors | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | |

Shareholder Proposals for 2017 Annual Meeting

| | 56 |

Appendix A

| | 57 |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 25, 201629, 2024

This Proxy Statement, our 20152023 Annual Report and a form of proxy card are available at www.proxyvote.com. You will need your Notice of Internet Availability or proxy card to access the proxy materials. As permitted by rules adopted by the Securities and Exchange Commission

("SEC"(“SEC”), we are furnishing our proxy materials over the Internet to some of our shareholders. This means that some shareholders will not receive paper copies of these

documents. Instead, these shareholdersdocuments but instead will receive only a Notice of Internet Availability containing instructions on how to access the proxy materials over the

Internet. The Notice of Internet

Availability also contains instructions onand how

each of those shareholders canto request a paper copy of our proxy materials, including the Proxy Statement, our

20152023 Annual Report, and a proxy card. Shareholders who do not receive a Notice of Internet Availability will receive a paper copy of the proxy materials by mail, unless they have previously requested delivery of proxy materials electronically.

If you received only the Notice of Internet Availability and would like to receive a paper copy of the proxy materials, the notice contains instructions on how you can request copies of these documents.

2024 Proxy Statement ![[MISSING IMAGE: lg_dollargeneral-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044304/lg_dollargeneral-pn.jpg)

PROXY STATEMENT

This document is the Proxy Statementproxy statement of Dollar General Corporation for thethat we use to solicit your proxy to vote upon certain matters at our Annual Meeting of Shareholders to be held on Wednesday, May 25, 2016.29, 2024. We will begin mailing to shareholders printed copies of this document and the form of proxy or the Notice of Internet Availability to shareholders on or about April 8, 2016. 5, 2024.

We include website addresses and references to our Serving Others report and our Report on Audit of Dollar General Safety Policies and Practices in this proxy statement for reference only. The information contained in these websites and reports is not incorporated by reference into, and does not form a part of, this proxy statement.

SOLICITATION, MEETING AND VOTING INFORMATION

What is Dollar General Corporation and where is it located?

Dollar General Corporation (NYSE: DG) is proud to serve as America’s neighborhood general store. Founded in 1939, Dollar General lives its mission of Serving Others every day by providing access to affordable products and services for its customers, career opportunities for its employees, and literacy and education support for its hometown communities. As of March 1, 2024, the Company’s 20,022 Dollar General, DG Market, DGX and pOpshelf stores across the United States and Mi Súper Dollar General stores in Mexico provide everyday essentials including food, health and wellness products, cleaning and laundry supplies, self-care and beauty items, and seasonal décor from our high-quality private brands alongside many of the world’s most trusted brands. Our principal executive offices are providing this document to solicit your proxy to vote upon certain matterslocated at the annual meeting.100 Mission Ridge, Goodlettsville, Tennessee 37072.

We

also refer to our company as

"we," "us"“we,” “us” or

"Dollar“Dollar General.

"” Unless otherwise noted or required by

the context,

"2016," "2015," "2014," "2013,"“2024,” “2023,” “2022,” and

"2012"“2021” refer to our fiscal years ending or ended

January 31, 2025, February 2, 2024, February 3,

2017,2023, and January

29, 2016, January 30, 2015, January 31, 2014, and February 1, 2013,28, 2022, respectively.

What is a proxy

and who is asking for it and

who is paying for the cost to solicit it?

A proxy is your legal designation of another person, called a

"proxy,"“proxy,” to vote your stock. The document

that designatesdesignating someone as

youra proxy is also called a proxy or a proxy card.

Our directors, officers and employees are soliciting your proxy on behalf of our Board of

Directors.Directors and will not be specially paid for doing so. Solicitation of proxies by mail may be supplemented by telephone, email and other electronic means, advertisements, personal solicitation, news releases issued by Dollar General, postings on our website or otherwise. Dollar General will pay all

solicitation expenses.expenses of this solicitation. We

will not additionally compensate these personshave retained Innisfree M&A Incorporated to

solicit your proxy but will reimburse them for any out-of-pocket expenses they incur. We also may reimburse custodians and nominees for their expenses in sending proxy materials to beneficial owners.Who may attend the annual meeting?

Only shareholders, their proxy holders and our invited guests may attend the meeting. If your shares are registered in the name of a broker, trust, bank or other nominee, you will need to bringact as a proxy orsolicitor for a letter from that record holder or your most recent brokerage account statement that confirms your ownershipfee estimated to be $17,500, plus reimbursement of those shares asout of March 17, 2016. For security reasons, we also may require photo identification for admission.

Where can I find directions to the annual meeting?

Directions to Goodlettsville City Hall, where we will hold the annual meeting, are posted on the "Investor Information" section of our website located at www.dollargeneral.com.

pocket expenses.

Will the annual meeting be webcast?

Yes.

You are invited to visit the "Conference Calls and Investor Events" sectionA live webcast of the

"Investor Information" section of our website located at www.dollargeneral.comannual meeting, including the question and answer session, will be available on https://investor.dollargeneral.com under “News and Events—Events and Presentations” at 9:00 a.m., Central Time, on May

25, 2016 to access29, 2024. Within 24 hours following the

live webcast of the annual meeting. An archived copymeeting, a recording of the webcast will be available on our website for at least

6030 days. The information on our website, however, is not incorporated by reference into, and does not form a part of, this proxy statement.

What is Dollar General Corporation

Who may attend the annual meeting?

Only shareholders as of the record date, March 20, 2024 (the “Record Date”), their duly appointed proxy holders, and where is it located? Dollar General has been delivering valueour invited guests may attend the annual meeting. To be admitted to shoppers for over 75 years. Dollar General helps shoppers Save time. Save money. Every day!® by offering products that are frequently usedthe meeting, you must present a government-issued photo identification and replenished, suchproof of share ownership as food, snacks, healthof the Record Date. To prove ownership, we will verify shareholders of record against our list of registered shareholders, while street name shareholders must show: an account statement bearing their name and beauty aids, cleaning supplies, clothingshowing their share ownership as of the Record Date; a valid legal proxy from the broker, trustee, bank or nominee holding the shares; a letter from a broker, trustee, bank or nominee holding the shares confirming the beneficial owner’s ownership as of the Record Date; or other similar evidence of ownership.

We reserve the right to deny admittance to anyone who does not comply with these requirements or with the Rules of Conduct for the family, housewaresmeeting. We will decide in our sole discretion whether your documentation meets the admission requirements. If you hold shares in a joint account, both owners can be admitted to the meeting if proof of joint ownership is provided and seasonal itemsyou both provide the required identification.

Where can I find directions to the annual meeting?

Directions to the annual meeting are posted on our website at low everyday prices in convenient neighborhood locations. Dollar General operates 12,575 stores in 43 states ashttps://investor.dollargeneral.com.

![[MISSING IMAGE: lg_dollargeneral-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044304/lg_dollargeneral-pn.jpg) 2024 Proxy Statement1

2024 Proxy Statement1

SOLICITATION, MEETING AND VOTING INFORMATION

Who may vote at the annual meeting?

You may vote if you owned shares of

February 26, 2016. Our principal executive offices are located at 100 Mission Ridge, Goodlettsville, Tennessee 37072. Our telephone number is 615-855-4000.Where is Dollar General common stock traded?

Our stock is tradedat the close of business on the New York Stock Exchange ("NYSE") under the symbol "DG."

TableRecord Date (March 20, 2024). As of Contents

VOTING MATTERS

that date, there were 219,670,239 shares of Dollar General common stock outstanding and entitled to vote. Each share is entitled to one vote on each matter.

How many votes must be present to hold the annual meeting?

A quorum, consisting of the presence in person or by proxy of the holders of a majority of shares of our common stock outstanding on

March 17, 2016,the Record Date, must exist to conduct

any business at the

meeting.What if a quorum is not present at the annual meeting?

meeting. If a quorum is not present, the presiding officer at the meeting any officer entitled to preside at or to act as Secretary of the meeting shall have power tomay adjourn the meeting from time to time until a quorum is present.

You will be asked to vote on:

| | | |

| •

| | the election of 8 directors; and |

| •

| | the ratification of the appointment of our independent registered public accounting firm (the "independent auditor") for 2016.

|

•

May other matters be raised at the

annual meeting?election of the 9 nominees listed in this proxy statement (Proposal 1);

•

the approval on an advisory basis of our named executive officer compensation as disclosed in this proxy statement (Proposal 2);

•

the ratification of the appointment of our independent registered public accounting firm (the “independent auditor”) for 2024 (Proposal 3); and

•

the shareholder proposal described in this proxy statement (Proposal 4) if properly presented.

We are unaware of other matters to be acted upon at the

annual meeting. Under Tennessee law and our governing documents, no other non-procedural business may be raised at the meeting unless proper notice has been given to shareholders.

If other business is properly raised, your proxies have authority to vote as they think best, including to adjourn the meeting.Who is entitled to vote at the annual meeting?

You may vote if you owned shares of Dollar General common stock at the close of business on March 17, 2016. As of that date, there were 286,669,916 shares of Dollar General common stock outstanding and entitled to vote. Each share is entitled to one vote on each matter.

What is the difference between a "shareholder of record" and a "street name" holder?

You are a "shareholder of record" if your shares are registered directly in your name with Wells Fargo Shareowner Services, our transfer agent. You are a "street name" holder if your shares are held in the name of a brokerage firm, bank, trust or other nominee as custodian.

If you are a shareholder of record, you may vote your proxy over the telephone or Internet or, if you received printed proxy materials, by marking, signing, dating and returning the printed proxy card in the enclosed envelope. Please refer to the

instructions on the Notice of Internet Availability or proxy card, as

applicable.applicable, for the telephone number, Internet address and other instructions. Alternatively, you may vote

your shares in person at the

annual meeting.

Even if you plan to attend the meeting, we recommend that you vote in advance so that your vote will be counted if you later decide not to attend the meeting.

If you are a street name holder, your broker, trustee, bank or other nominee will provide materials and instructions for voting your shares. You also may vote in person at the meeting if you obtain and bring to the meeting a legal proxy from your broker, banker, trustee or other nominee giving you the right to vote the shares.

In either case, shareholders wishing to attend the meeting must also comply with the requirements described above under “Who may attend the annual meeting.”

TableWhat is the difference between a “shareholder of

Contentsrecord” and a “street name” holder?

You are a “shareholder of record” if your shares are registered directly in your name with EQ Shareowner Services, our transfer agent. You are a “street name” holder if your shares are held in the name of a brokerage firm, bank, trust or other nominee as custodian.

What if I receive more than one Notice of Internet Availability or proxy card?

You will receive multiple Notices of Internet Availability or proxy cards if you hold shares in different ways (e.g., joint tenancy, trusts, custodial accounts, etc.) or in multiple accounts. Street name holders will receive the Notice of Internet Availability or proxy card or other voting information, along with voting instructions, from their brokers. Please vote the shares represented by each Notice of Internet Availability or proxy card you receive to ensure that all your shares are voted.

How will my proxy be voted?

The persons named on the proxy card will vote your proxy as you

direct or, ifdirect. If you return a signed proxy card or complete the Internet or telephone voting procedures but do not specify how you want to vote your

shares: "FOR" all directors nominated and "FOR" ratificationshares, the persons named on the proxy card will vote your shares in accordance with the recommendations of

Ernst & Young LLPour Board of Directors. If business other than that described in this proxy statement is properly raised, your proxies have authority to vote as

our independent auditor for 2016.they think best, including to adjourn the annual meeting.

Can I change my mind and revoke my proxy?

Yes. A shareholder of record may revoke a proxy given pursuant to this solicitation by:

| | | |

| •

| | •

signing a valid, later-dated proxy card and submitting it so that it is received before the annual meeting in accordance with the instructions included in the proxy card; •

at or before the meeting, submitting to our Corporate Secretary a written notice of revocation dated later than the date of the proxy; •

submitting a later-dated vote by telephone or Internet no later than 11:59 p.m. Eastern Time on May 28, 2024; or •

attending the meeting and voting in person. Note that it is received before the annual meeting in accordance with the instructions included in the proxy card; |

| •

| | at or before the annual meeting, submitting to our Corporate Secretary a written notice of revocation dated later than the date of the proxy;

|

| •

| | submitting a later-dated vote by telephone or Internet no later than 11:59 p.m., Eastern time, on May 24, 2016; or

|

| •

| | attending the annual meeting and voting in person.

|

Your attendance at the annual meeting, by itself, will not revoke your proxy.

22024 Proxy Statement ![[MISSING IMAGE: lg_dollargeneral-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044304/lg_dollargeneral-pn.jpg)

SOLICITATION, MEETING AND VOTING INFORMATION

A street name holder may revoke a proxy given pursuant to this solicitation by following the instructions of the bank, broker, trustee or other nominee who holds his or her shares.

How many votes are needed to elect directors?

To be elected at the annual meeting, a nominee must receive the affirmative vote of a majority of votes cast by holders of shares entitled to vote at the meeting. Under our

Amended and Restated Charter, the

"affirmative“affirmative vote of a majority of votes

cast"cast” means that the number of votes cast in favor of a

nominee'snominee’s election exceeds the number of votes cast against his or her election. You may vote in favor of or against the election of each nominee, or you may elect to abstain from voting your shares.

What happens if a director fails to receive the required vote for election?

An incumbent director who does not receive the required vote for election at the annual meeting must promptly tender a resignation as a director for the Board's consideration by our Board of Directors pursuant to our Board-approved director resignation policy outlined in our Corporate Governance Guidelines.policy. Each director standing for re-electionelection at the annual meeting has agreed to resign, effective upon the Board'sBoard’s acceptance of such resignation, if he or she does not receive a majority vote. If the Board rejects the offered resignation, the director will continue to serve until the next annual shareholders'shareholders’ meeting and until his or her successor is duly elected or his or her earlier resignation or removal in accordance with our Amended and Restated Bylaws ("Bylaws").Bylaws. If the Board accepts the offered resignation, the Board, in its sole discretion, may fill the resulting vacancy or decrease the size of the Board.Board’s size.

Table of Contents

How many votes are needed to approve other matters?

The proposal to

Proposal 2 (to approve on an advisory basis our named executive officer compensation), Proposal 3 (to ratify the appointment of our independent auditor for

20162024), and Proposal 4 (a shareholder proposal described in this proxy statement) will be approved if the votes cast in favor of

suchthe applicable proposal exceed the votes cast against it.

The vote on the compensation of our named executive officers is advisory and, therefore, not binding on Dollar General, our Board of Directors, or its Compensation Committee. With respect to this proposal,each of these proposals, and any other matter properly brought before the annual meeting, you may vote in favor of or against the proposal, or you may elect to abstain from voting your shares.

How will abstentions and broker non-votes be treated?

Abstentions and broker non-votes will be treated as shares that are present and entitled to vote for purposes of determining whether a quorum is present but will not be

counted as votes cast either in favor of or against a particular proposal and will have no effect on the outcome of the particular proposal.

What are broker non-votes?

Although your broker is the record holder of any shares that you hold in street name, it must vote those shares pursuant to your instructions. If you do not provide instructions, your broker may exercise discretionary voting power over your shares for

"routine"“routine” items but not for

"non-routine"“non-routine” items.

The election of directors is considered to be a non-routine item, whileAll matters described in this proxy statement, except for the ratification of the appointment of our independent auditor,

isare considered to be

a routine matter. "Broker non-votes"non-routine matters.

“Broker non-votes” occur when shares held of record by a broker are not voted on a matter because the

brokerstreet name holder of the shares has not

receivedprovided voting instructions

fromand the

beneficial owner andbroker either lacks or declines to exercise the authority to vote the shares in its discretion.

How

will abstentions and broker non-votes be treated? Abstentions and broker non-votes, if any, will be treated as shares that are present andcan I ask questions or view the list of shareholders entitled to vote for purposesat the annual meeting?

You may submit pertinent questions in advance of

determining whetherthe annual meeting from May 15, 2024 through May 24, 2024, by visiting www.proxyvote.com and entering your Control Number, which is a

quorum is present but will not be counted as votes cast either in favor of or against a particular proposal and will have no effect on the outcome of a particular proposal.Will my vote be confidential?

Proxy instructions, ballots and voting tabulations16-digit number that identify individual shareholders are handled in a manner that is intended to protect your voting privacy. Your vote will not be intentionally disclosed either within Dollar General or to third parties, except (1) as necessary to meet applicable legal requirements; (2) in a dispute regarding authenticity of proxies and ballots; (3)you can find in the caseNotice of a contested proxy solicitation, if the other party soliciting proxies does not agree to comply with the confidential voting policy; (4) to allow for the tabulation of votes and certification of the vote; (5) to facilitate a successful proxy solicitation;Internet Availability or (6) when a shareholder makes a written comment on the proxy card (in each case if you are a shareholder of record), as applicable, or otherwise communicatesin the voting instruction form (if you are a street name holder). If you attend the meeting in person and meet the additional requirements set out in the Rules of Conduct for the meeting, you also may submit pertinent questions at the meeting. Rules of Conduct for the meeting, including without limitation rules pertaining to submission of questions, will be available prior to the meeting on www.proxyvote.com and at the meeting. We encourage you to review in advance the Rules of Conduct for the meeting.

During the meeting, shareholders of record may examine the list of shareholders entitled to vote at the meeting, which list will be available at the meeting. To inspect such shareholder list prior to management.the meeting, please contact our Investor Relations department at 615-855-5529 or investorrelations@dollargeneral.com.

![[MISSING IMAGE: lg_dollargeneral-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044304/lg_dollargeneral-pn.jpg) 2024 Proxy Statement3

2024 Proxy Statement3

PROPOSAL 1:

ELECTION OF DIRECTORS

Election of Directors What is the structure of the Board of Directors?

Our Board of Directors must consist of 1 to 15 directors, with the exact number

currently fixed at 8, set by the Board.

The Board size is currently fixed at 9. All directors are elected annually by our shareholders.

Who are the nominees this year?

The nominees for the Board of Directors consist of the 8 current directors. If elected, each nominee would hold office until the 2017 annual meeting of shareholders and until his or her successor is elected and qualified, subject to any earlier resignation or removal. These nominees, their ages at the date of this proxy statement and the calendar year in which they first became a director are listed in the table below.

| | | | |

| Name | | Age | | Director Since |

|---|

Warren F. Bryant | | 70 | | 2009 |

Michael M. Calbert | | 53 | | 2007 |

Sandra B. Cochran | | 57 | | 2012 |

Patricia D. Fili-Krushel | | 62 | | 2012 |

Paula A. Price | | 54 | | 2014 |

William C. Rhodes, III | | 50 | | 2009 |

David B. Rickard | | 69 | | 2010 |

Todd J. Vasos | | 54 | | 2015 |

What are the backgrounds of this year's nominees?

Mr. Bryant served as the President and Chief Executive Officer of Longs Drug Stores Corporation, a retail drugstore chain on the West Coast and in Hawaii, from 2002 through 2008 and as its Chairman of the Board from 2003 through his retirement in 2008. Prior to joining Longs Drug Stores, he served as a Senior Vice President of The Kroger Co., a retail grocery chain, from 1999 to 2002. Mr. Bryant is a director of Office Depot, Inc. and Loblaw Companies Limited of Canada and served as a director of OfficeMax Incorporated from 2004 to 2013.

Mr. Calbert has served as our Chairman of the Board since January 30, 2016. He joined KKR & Co. L.P. ("KKR") in January 2000 and was directly involved with several KKR portfolio companies until his retirement in January 2014. Mr. Calbert led the Retail industry team within KKR's Private Equity platform prior to his retirement and served as a consultant to KKR from his retirement until June 2015. Mr. Calbert joined Randall's Food Markets beginning in 1994 and served as the Chief Financial Officer from 1997 until it was sold in September 1999. Mr. Calbert also previously worked as a certified public accountant and consultant with Arthur Andersen Worldwide from 1985 to 1994, where his primary focus was the retail and consumer industry. He previously served as our Chairman of the Board from July 2007 until December 2008 and as our lead director from March 2013 until his re-appointment as our Chairman of the Board in January 2016.

Ms. Cochran has served as a director and as President and Chief Executive Officer of Cracker Barrel Old Country Store, Inc. since September 2011. She joined Cracker Barrel in April 2009 as Executive Vice President and Chief Financial Officer, and was named President and Chief Operating Officer in November 2010. She was previously Chief Executive Officer at book retailer Books-A-Million, Inc. from February 2004 to April 2009. She also served as that company's President (August 1999—February 2004), Chief Financial Officer (September 1993—August 1999) and Vice President of Finance (August 1992—September 1993). Ms. Cochran has over 20 years of experience in the retail industry. Ms. Cochran has served as a director of Lowe's Companies, Inc. since January 2016.

Table of Contents

Ms. Fili-Krushel is the former Executive Vice President for NBCUniversal where she served as a strategist and key advisor to the CEO of NBCUniversal from April 2015 to November 2015. She served as Chairman of NBCUniversal News Group, a division of NBCUniversal Media, LLC, composed of NBC News, CNBC, MSNBC and the Weather Channel, from July 2012 until April 2015. She previously served as Executive Vice President of NBCUniversal (January 2011—July 2012) with a broad portfolio of functions reporting to her, including operations and technical services, business strategy, human resources and legal. Prior to NBCUniversal, Ms. Fili-Krushel was Executive Vice President of Administration at Time Warner Inc. (July 2001—December 2010) where her responsibilities included oversight of philanthropy, corporate social responsibility, human resources, worldwide recruitment, employee development and growth, compensation and benefits, and security. Before joining Time Warner in July 2001, Ms. Fili-Krushel had been Chief Executive Officer of WebMD Health Corp. since April 2000. From July 1998 to April 2000, Ms. Fili-Krushel was President of the ABC Television Network, and from 1993 to 1998 she served as President of ABC Daytime. Before joining ABC, she had been with Lifetime Television since 1988. Prior to Lifetime, Ms. Fili-Krushel held several positions with Home Box Office. Before joining HBO, Ms. Fili-Krushel worked for ABC Sports in various positions.

Ms. Price has been Senior Lecturer at Harvard Business School in the Accounting and Management Unit since July 2014. She was Executive Vice President and Chief Financial Officer of Ahold USA from May 2009 until January 2014. At Ahold, which operates more than 700 supermarkets under the Stop & Shop, Giant and Martin's names as well as the Peapod online grocery delivery service, Ms. Price was responsible for finance, accounting and shared services, strategic planning, real estate development, store format and construction, and information technology. Before joining Ahold, she was the Senior Vice President, Controller and Chief Accounting Officer at CVS Health Corporation (formerly CVS Caremark Corporation) from July 2006 until August 2008. Earlier in her career, Ms. Price served as the Chief Financial Officer for the Institutional Trust Services division of JPMorgan Chase (from August 2002 until September 2005), and held several other senior management positions in the U.S. and the U.K. in the financial services and consumer packaged goods industries. A certified public accountant, she began her career at Arthur Andersen & Co. Ms. Price has also served as a director of Accenture plc since May 2014 and Western Digital Corporation since July 2014 and served as a director of Charming Shoppes, Inc. (Lane Bryant, Catherine's, Fashion Bug, Cacique and Figi's brands) from March 2011 until it was sold in June 2012.

Mr. Rhodes was elected Chairman of AutoZone, Inc., a specialty retailer and distributor of automotive replacement parts and accessories, in June 2007. He has served as President and Chief Executive Officer and as a director of AutoZone since 2005. Prior to his appointment as President and Chief Executive Officer, Mr. Rhodes was Executive Vice President—Store Operations and Commercial. Prior to 2004, he had been Senior Vice President—Supply Chain and Information Technology since 2002, and prior thereto had been Senior Vice President—Supply Chain since 2001. Prior to that time, he served in various capacities with AutoZone since 1994, including Vice President—Stores in 2000, Senior Vice President—Finance and Vice President—Finance in 1999, and Vice President—Operations Analysis and Support from 1997 to 1999. Prior to 1994, Mr. Rhodes was a manager with Ernst & Young LLP.

Mr. Rickard served as the Executive Vice President, Chief Financial Officer and Chief Administrative Officer of CVS Health Corporation (formerly CVS Caremark Corporation), a retail pharmacy chain and provider of healthcare services and pharmacy benefits management, from September 1999 until his retirement in December 2009. Prior to joining CVS, Mr. Rickard was the Senior Vice President and Chief Financial Officer of RJR Nabisco Holdings Corporation from March 1997 to August 1999. Previously, he was Executive Vice President of International Distillers and Vintners Americas. Mr. Rickard is a director of Harris Corporation and Jones Lang LaSalle Incorporated.

Table of Contents

Mr. Vasos has served as Chief Executive Officer and a member of our Board since June 3, 2015. He joined Dollar General in December 2008 as Executive Vice President, Division President and Chief Merchandising Officer. He was promoted to Chief Operating Officer in November 2013. Prior to joining Dollar General, Mr. Vasos served in executive positions with Longs Drug Stores Corporation for seven years, including Executive Vice President and Chief Operating Officer (February 2008 through November 2008) and Senior Vice President and Chief Merchandising Officer (2001—2008), where he was responsible for all pharmacy and front-end marketing, merchandising, procurement, supply chain, advertising, store development, store layout and space allocation, and the operation of three distribution centers. He also previously served in leadership positions at Phar-Mor Food and Drug Inc. and Eckerd Corporation.

How are directors identified and nominated?

All nominees for election as directors at the annual meeting currently serve on our Board of Directors

The Nominating, Governance and

were nominated by the Board for election or re-election, as applicable, upon the recommendation of the Nominating and GovernanceCorporate Responsibility Committee (the

"Nominating Committee"“Nominating Committee”)

. The Nominating Committee is responsible for identifying, evaluating and recommending director candidates,

while our Board is responsible for nominatingincluding the

director slate

to be presented to shareholders for election at the annual

meeting.meeting, to our Board of Directors, which makes the ultimate election or nomination determination, as applicable. The Nominating Committee's charter and our Corporate Governance Guidelines require the Nominating Committee to consider candidates submitted by our shareholders in accordance with the notice provisions of our Bylaws (see "Can shareholders nominate directors?" below) and to apply the same criteria to the evaluation of those candidates as it applies to other director candidates. The Nominating Committee also may use a variety of other methods to identify potential director candidates, such as recommendations by our directors, management, shareholders or third-party search firms.

Our employment agreement with The Nominating Committee has retained a third-party search firm to assist in identifying potential Board candidates who meet our qualification and experience requirements and, for any such candidate identified by such search firm, to compile and evaluate

information regarding the candidate’s qualifications and experience and to conduct reference checks. Mr. Vasos requiresDavid Rowland, a nominee for election at the annual meeting, was identified as a candidate by a third-party search firm.

Does the Board orconsider diversity when identifying director nominees?

Yes. Our Board of Directors values diversity in its broadest sense (including gender and race) and has adopted a

duly authorized committeewritten policy to endeavor to achieve a mix of

members that represents a diversity of background and experience in areas that are relevant to our business. Similar to the

Board“Rooney Rule,” this policy further provides that the Nominating Committee should seek to

nominate himinclude qualified women and individuals from underrepresented groups in the pool from which candidates are selected and to

servedirect any search firm accordingly. The Committee periodically assesses this policy’s effectiveness as

a memberpart of its annual performance evaluation. The matrix included below illustrates the diverse experience and composition of our Board

each yearand reflects the key skills, qualifications and experience that

he is slated for re-electionour Board has determined to

the Board. Our failure to do so could give rise to a claim for breachbe important in light of

contractour current and

may constitute good reason for employment termination by Mr. Vasos under the employment agreement.expected business needs.

42024 Proxy Statement ![[MISSING IMAGE: lg_dollargeneral-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044304/lg_dollargeneral-pn.jpg)

PROPOSAL 1: Election of Directors

How are nominees evaluated; what are the

minimumthreshold qualifications?

Subject to Mr. Vasos's employment agreement discussed above, the

The Nominating Committee is charged with recommending to

theour Board of Directors only those candidates that it believes are qualified to serve as Board members consistent with the

director selection criteria

for selection of new directors adopted from time to timeestablished by the

Board and who have not achieved the age of 76, unless the Board has approved an exception to this limit on a case by case basis. If a waiver is granted, it will be reviewed annually. We have a written policy to endeavor to achieve a mix of Board members that represent a diversity of background and experience in areas that are relevant to our business. To implement this policy, the Committee assesses diversity by evaluating each candidate's individual qualifications in the context of how that candidate would relate to the Board as a whole and also considers more traditional concepts of diversity. The Committee periodically assesses the effectiveness of this policy by considering whether the Board as a whole represents such diverse experience and composition and by recommending to the Board changes to the criteria for selection of new directors as appropriate. The Committee recommends candidates, including those submitted by shareholders, only if it believes the candidate's knowledge, experience and expertise would strengthen the Board and that the candidate is committed to representing the long-term interests of all Dollar General shareholders.

Board.

Table of Contents

The Nominating Committee assesses a candidate'scandidate’s independence, background, experience and experience,time commitments, as well as the current Board'sour Board’s skill needs and diversity.needs. With respect to incumbent directors, considered for re-election, the Committee also assesses each director'sthe meeting attendance record and suitability for continued service. In addition, theThe Committee determines that all nominees arewhether each nominee is in a position to devote an adequate amount of time to the effective performance of director duties and possesspossesses the following threshold characteristics: integrity and accountability, informed judgment, financial literacy, a cooperative approach, a record of achievement, loyalty, and the ability to consult with and advise management.

What particular The Committee recommends candidates, including those submitted by shareholders, only if it believes a candidate’s knowledge, experience qualifications, attributes or skills ledand expertise would strengthen the Board and that the candidate is committed to representing our shareholders’ long-term interests. While our focus and priorities may change from time to time, the Board of Directors Experience and Composition Matrix above summarizes the key skills, qualifications and experience

that our Board has determined to conclude that each nominee should servebe important in light of our current and expected business needs.

Who are the nominees this year?

All nominees standing for election as

a director of Dollar General? Ourdirectors at the annual meeting were nominated by our Board of Directors upon the recommendation of the Nominating Committee. The nominees include 8 incumbent directors who were elected at the 2023 annual meeting of shareholders, as well as Mr. Rowland who was appointed to our Board effective August 5, 2023. Our Board believes that each of the nominees can devote an adequate amount of time to the effective performance of director duties, is in compliance with our overboarding policy detailed in our Corporate Governance Guidelines, and possesses all of the minimumthreshold qualifications identified above.

If elected, each nominee would hold office until the 2025 annual meeting of shareholders and until his or her successor is elected and qualified, subject to any earlier resignation or removal.

The

Board has determined thatfollowing lists the nominees,

astheir ages at the date of this proxy statement and the calendar year in which they first became a

whole, complementdirector, along with their biographies and the experience, qualifications, attributes or skills that led our Board to conclude that each

other, meet the Board's skill needs, and represent diverse experience at policy-making levels in areas relevant to our business. The Board also considered the following in determining that the nomineesnominee should serve as

directorsa director of Dollar

General:General.

| | WARREN

F. BRYANT Age: 78 Director Since:

2009 | | | Biography: Mr. Bryant served as the President and Chief Executive Officer of Longs Drug Stores Corporation from 2002 through 2008 and as its Chairman of the Board from 2003 through his retirement in 2008. Prior to joining Longs Drug Stores, he served as a Senior Vice President of The Kroger Co. from 1999 to 2002. Mr. Bryant served as a director of Loblaw Companies Limited from May 2013 to May 2022, OfficeMax Incorporated from 2004 to 2013, and Office Depot, Inc. from November 2013 to July 2017. | |

| | Specific Experience, Qualifications, Attributes and Skills: Mr. Bryant has over 40 years of retail experience, including experience in marketing, merchandising, operations, and finance. His substantial experience in leadership and policy-making roles at other retail companies, together with his former experience as a board member for other retailers, provides him with an extensive understanding of our industry, as well as with valuable executive management skills, global, strategic planning, and risk management experience, and the ability to effectively advise our CEO. | |

![[MISSING IMAGE: lg_dollargeneral-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044304/lg_dollargeneral-pn.jpg) 2024 Proxy Statement5

2024 Proxy Statement5

PROPOSAL 1: Election of

retail experience, including experience in marketing, merchandising, operations and finance. His substantial experience in leadership and policy-making roles at other retail companies, together with his current and former experience as a board member for certain other retailers, provides him with an extensive understanding of our industry, as well as with valuable executive management skills and the ability to effectively advise our CEO.Mr. Calbert has considerable experience in managing private equity portfolio companies and is familiarDirectors

| | MICHAEL

M. CALBERT Age: 61 Director Since:

2007 | | | Biography: Mr. Calbert has served as our Chairman of the Board since January 2016. He joined the private equity firm KKR & Co. L.P. in January 2000 and was directly involved with several KKR portfolio companies until his retirement in January 2014, after which he served as a consultant to KKR until June 2015. Mr. Calbert led KKR’s Retail industry team prior to his retirement. He also served as the Chief Financial Officer of Randall’s Food Markets from 1997 until it was sold in September 1999 and worked as a certified public accountant and consultant with Arthur Andersen Worldwide from 1985 to 1994, where his primary focus was the retail and consumer industry. Mr. Calbert has served as a director of PVH Corp. since May 2022 and served as a director of Executive Network Partnering Corporation from September 2020 to October 2022 and AutoZone, Inc. from May 2019 to December 2021. He previously served as our Chairman of the Board from July 2007 until December 2008 and as our lead director from March 2013 until his re-appointment as our Chairman of the Board in January 2016. | |

| | Specific Experience, Qualifications, Attributes and Skills: Mr. Calbert has considerable experience in managing private equity portfolio companies and is experienced with corporate finance and strategic business planning activities. As the former head of KKR's Retail industry team, Mr. Calbert has a strong background and extensive experience in advising and managing companies in the retail industry, including evaluating business strategies and operations, financial plans and structures, risk, and management teams. His former service on various company boards in the retail industry including evaluating business strategies, financial plans and structures, and management teams. His former service on the board of directors of Academy, Ltd., Pets at Home Group Plc., Shoppers Drug Mart Corporation, Toys "R" Us, Inc. and US Foods, Inc. further strengthens his knowledge and experience within our industry. Mr. Calbert also has a significant financial and accounting background evidenced by his prior experience as the chief financial officer of a retail company and his 10 years of practice as a certified public accountant. | |

| | | |

| | ANA

M. CHADWICK Age: 52 Director Since:

2022 | | | Biography: Ms. Chadwick has served as Executive Vice President and Chief Financial Officer of Pitney Bowes Inc., a global shipping and mailing company providing technology, logistics, and financial services to small and medium sized businesses, large enterprises, retailers and government clients, since January 2021, and she has announced her resignation from Pitney Bowes effective April 21, 2024. Effective April 22, 2024, Ms. Chadwick will become Executive Vice President, Chief Financial Officer and Treasurer of Insulet Corporation, a medical device company. She previously served for 28 years in various roles at General Electric Company, including President and Chief Executive Officer of GE Capital Global Legacy Solutions (March 2019 to January 2021); Chief Financial Officer and Chief Operating Officer of GE Capital Global Legacy Solutions (February 2016 to February 2019); Controller of GE Capital Americas (September 2014 to January 2016); Chief Financial Officer of GE Capital Energy Financial Services (July 2010 to August 2014); Chief Operating Officer of GE Capital Global Banking—GE Money Bank Latin America (February 2009 to June 2010); Chief Financial Officer of GE Capital Consumer Finance—Latin America (December 2005 to January 2009); Chief Financial Officer of GE Capital Consumer Finance—GE Capital Bank Switzerland (December 2003 to November 2005); and a variety of finance and audit positions of increasing responsibility since joining the company in June 1993. | |

| | Specific Experience, Qualifications, Attributes and Skills: Ms. Chadwick has significant financial and risk management expertise and over 30 years of experience in various financial planning, audit, banking, and accounting roles. Through these various roles, she has led large global teams of employees and played a critical role in various joint ventures, divestitures and restructurings. These experiences bring deep and disciplined perspective to our Audit Committee and Board. In addition, having lived and worked in several Latin American countries, including growing businesses in Latin America, she brings valuable perspective to our Board as the Company works to expand its operations into Mexico and to further serve its diverse customer base in the United States. | |

62024 Proxy Statement ![[MISSING IMAGE: lg_dollargeneral-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044304/lg_dollargeneral-pn.jpg)

PROPOSAL 1: Election of Directors

| | PATRICIA

D. FILI-KRUSHEL Age: 70 Director Since:

2012 | | | Biography: Ms. Fili-Krushel served as Chairperson of the Board of Coqual, a non-profit think tank that focuses on global talent strategies, from February 2021 through June 2023 and as its Chief Executive Officer from September 2018 until January 2021. She previously was Executive Vice President (April 2015 to November 2015) of NBCUniversal, serving as a strategist and key advisor to the CEO; Chairman of NBCUniversal News Group (July 2012 to April 2015); and Executive Vice President of NBCUniversal (January 2011 to July 2012) overseeing the operations and technical services, business strategy, human resources and legal functions. She was Executive Vice President of Administration at Time Warner Inc. (July 2001 to December 2010) overseeing philanthropy, corporate social responsibility, human resources, worldwide recruitment, employee development and growth, compensation and benefits, and security; Chief Executive Officer of WebMD Health Corp. (April 2000 to July 2001); and President of ABC Television Network (July 1998 to April 2000). Ms. Fili-Krushel has served as a director of Reddit, Inc. since January 2022 and Chipotle Mexican Grill, Inc. since March 2019 and served as a director of I2PO from July 2021 to July 2022. | |

| | Specific Experience, Qualifications, Attributes and Skills: Ms. Fili-Krushel’s background increases the breadth of experience of our Board as a result of her extensive executive experience overseeing the business strategy, philanthropy, corporate social responsibility, human resources, recruitment, employee growth and development, compensation and benefits, and legal functions, along with associated risks, at large public companies in the media industry. She also brings valuable oversight experience in diversity-related workplace matters, as well as digital and e-commerce experience. In addition, her understanding of consumer behavior based on her knowledge of viewership patterns and preferences provides a different perspective to our Board in understanding our customer base, and her other public company board experience brings additional perspective to our Board. | |

| | | |

| | TIMOTHY

I. MCGUIRE Age: 63 Director Since:

2018 | | | Biography: Mr. McGuire served as Chief Executive Officer of Mobile Service Center Canada, Ltd. (d/b/a Mobile Klinik, a business division of TELUS Corporation), a chain of professional smartphone repair stores, from October 2018 through August 2022, and as its Chairman of the Board from June 2017 to October 2018 and director from March 2017 to July 2020. He retired from McKinsey & Company, a worldwide management consulting firm, in August 2017 after serving as a leader of its global retail and consumer practice for almost 28 years, including leading the Americas retail practice for five years. While at McKinsey, Mr. McGuire led consulting efforts with major retail, telecommunications, consumer service, and marketing organizations in Canada, the United States, Latin America, Europe, and Australia. He also co-founded McKinsey Analytics, a global group of consultants bringing advanced analytics capabilities to clients to help make better business decisions. Mr. McGuire also held various positions with Procter & Gamble (1983 to 1989), including Marketing Director for the Canadian Food & Beverage division. | |

| | Specific Experience, Qualifications, Attributes and Skills: Mr. McGuire brings over 30 years of valuable retail experience to our company. He has expertise in strategy, new store/concept development, marketing and sales, operations, international expansion, big data and advanced analytics, as well as risk management experience. In addition, Mr. McGuire’s focus while at McKinsey on use of advanced analytics in retail, developing and implementing growth strategies for consumer services, food, general-merchandise and multi-channel retailers, developing new retail formats, the application of lean operations techniques, the redesign of merchandise flows, supply-chain optimization efforts, and the redesign of purchasing and supplier-management approaches, brings extensive relevant perspectives to our Board as it seeks to consult and advise our CEO and to shape our corporate strategy. | |

![[MISSING IMAGE: lg_dollargeneral-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044304/lg_dollargeneral-pn.jpg) 2024 Proxy Statement7

2024 Proxy Statement7

PROPOSAL 1: Election of Directors

| | DAVID

P. ROWLAND Age: 63 Director Since:

2023 | | | Biography: Mr. Rowland served as Executive Chairman of the Board of Directors of Accenture plc, a leading global professional services company, from September 2019 to September 2021. Prior thereto, Mr. Rowland served as Accenture’s Interim Chief Executive Officer (January 2019 to September 2019); Chief Financial Officer (July 2013 to January 2019); Senior Vice President, Finance (September 2006 to July 2013); and a variety of consulting and finance leadership roles of increasing responsibility (July 1983 to September 2006). Mr. Rowland served as a director of Accenture plc from January 2019 to September 2021. | |

| | Specific Experience, Qualifications, Attributes and Skills: Mr. Rowland has significant senior leadership experience and financial and risk management expertise. He further provides vast technology experience as a result of leading one of the world’s largest technology and digital service providers and engaging with clients on strategies for driving large, complex technology-based programs. While at Accenture, he played a significant role in all aspects of the company’s strategic planning, in driving the company’s M&A strategy, and in shaping the company’s human capital strategy and managing the company’s global workforce. In addition, Mr. Rowland has extensive international experience as a result of leading a global organization with significant scale that serves many of the largest companies in the world. | |

| | | |

| | DEBRA

A. SANDLER Age: 64 Director Since:

2020 | | | Biography: Ms. Sandler has served as President and Chief Executive Officer of La Grenade Group, LLC, a marketing consultancy that serves packaged goods companies operating in the health and wellness space, since September 2015. She also has served as Chief Executive Officer of Mavis Foods, LLC, a startup she founded that makes and sells Caribbean sauces and marinades, since April 2018. Ms. Sandler previously served seven years with Mars, Inc., including Chief Health and Wellbeing Officer (July 2014 to July 2015); President, Chocolate North America (April 2012 to July 2014); and Chief Consumer Officer, Chocolate (November 2009 to March 2012). She also held senior leadership positions with Johnson & Johnson from 1999 to 2009, where her last position was Worldwide President for McNeil Nutritionals LLC, a fully integrated business unit within the Johnson & Johnson Consumer Group of Companies. She began her career in 1985 with PepsiCo, Inc., where she served for 13 years in a variety of marketing positions of increasing responsibility. Ms. Sandler has served as a director of Keurig Dr Pepper Inc. since March 2021, Archer Daniels Midland Company since May 2016 and Gannett Co., Inc. since June 2015. | |

| | Specific Experience, Qualifications, Attributes and Skills: Ms. Sandler has strong marketing and operating experience and a proven record of creating, building, enhancing, and leading well-known consumer brands as a result of the leadership positions she has held with Mars, Johnson & Johnson, and PepsiCo. These positions have required an extensive understanding of consumer behavior and the evolving retail environment. In addition, her launch of Mavis Foods has provided her with valuable e-commerce, strategic planning and financial experience, and her other public company board experience brings additional perspective to our Board. | |

82024 Proxy Statement ![[MISSING IMAGE: lg_dollargeneral-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044304/lg_dollargeneral-pn.jpg)

PROPOSAL 1: Election of Directors

| | RALPH

E. SANTANA Age: 56 Director Since:

2018 | | | Biography: Mr. Santana has served as Chief Executive Officer of Recteq Grills, a pellet grill company, since June 2022. He previously served as Executive Vice President and Chief Marketing Officer of Harman International Industries, a wholly-owned subsidiary of Samsung Electronics Co., Ltd., from April 2013 until June 2022, with responsibility for Harman’s worldwide marketing strategy and global design group, and as Senior Vice President and Chief Marketing Officer of Samsung Electronics North America (June 2010 to September 2012), where he was responsible for launching Samsung’s U.S. e-commerce business. He also served 16 years at PepsiCo, Inc. (June 1994 to May 2010) in multiple international and domestic leadership roles in marketing, including Vice President of Marketing, North American Beverages, Pepsi-Cola, and held positions with its Frito-Lay’s international and North America operations. Mr. Santana began his career at Beverage Marketing Corporation (July 1989 to June 1992) where he served as a beverage industry consultant designing market entry and expansion strategies. | |

| | Specific Experience, Qualifications, Attributes and Skills: Mr. Santana has almost 30 years of marketing experience spanning multiple technology and food and beverage consumer packaged goods categories. His deep understanding of digital marketing and retail shopper marketing, particularly in the area of consumer packaged goods, and his extensive experience in shaping multi-cultural strategy, executing marketing programs, and making brands culturally relevant further enhances our Board’s ability to provide oversight and thoughtful counsel to management in these important and evolving areas of our business. His previous and current executive positions also provide risk management experience. | |

| | | |

| | TODD

J. VASOS Age: 62 Director Since:

2015 | | | Biography: Mr. Vasos has served as our Chief Executive Officer since October 2023 and as a member of our Board of Directors since June 2015. He previously served as our Chief Executive Officer from June 2015 to November 2022, when he transitioned to Senior Advisor prior to retiring in April 2023. Mr. Vasos joined Dollar General in December 2008 as Executive Vice President, Division President and Chief Merchandising Officer and was promoted to Chief Operating Officer in November 2013. Prior to joining Dollar General, Mr. Vasos served in leadership positions with Longs Drug Stores Corporation, Phar-Mor Food and Drug Inc. and Eckerd Corporation. Mr. Vasos has served as a director of KeyCorp since July 2020. | |

| | Specific Experience, Qualifications, Attributes and Skills: Mr. Vasos has extensive retail experience, including approximately 15 years with Dollar General. He has a thorough understanding of all key areas of our business, which is further bolstered by his former experience overseeing the merchandising, operations, marketing, advertising, global procurement, supply chain, store development, store layout and space allocation functions of other retail companies. In addition, Mr. Vasos’s service in leadership and policy-making positions in the retail business has provided him with additional leadership and strategic planning skills that allow him to effectively guide and oversee the direction of Dollar General and the consensus-building skills required to lead our management team, and his other public company board experience brings additional perspective to his leadership of Dollar General. | |

![[MISSING IMAGE: lg_dollargeneral-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044304/lg_dollargeneral-pn.jpg) 2024 Proxy Statement9

2024 Proxy Statement9

PROPOSAL 1: Election of Directors

Can shareholders recommend or nominate directors?

Yes. Shareholders may recommend candidates to our Nominating Committee by providing the same information within the

retail industry. Mr. Calbert also has a significant financial and accounting background evidenced by his prior experience assame deadlines required for nominating candidates pursuant to the

chief financial officer of a retail company and his 10 years of practice as a certified public accountant.Ms. Cochran brings over 20 years of retail experienceadvance notice provisions in our Bylaws. Pursuant to Dollar General as a result of her current and former roles at Cracker Barrel Old Country Store and her former roles at Books-A-Million. This experience allows her to provide additional support and perspective toits Charter, our CEO and our Board. In addition, Ms. Cochran's industry and executive experience provides leadership, consensus-building, strategic planning, risk management and budgeting skills. Ms. Cochran also has significant financial experience, having served as the chief financial officer of two public companies and as vice president, corporate finance of SunTrust Securities, Inc., and our Board has determined that she qualifies as an audit committee financial expert.

Ms. Fili-Krushel's background increases the breadth of experience of our Board as a result of her extensive executive experience overseeing the business strategy, philanthropy, corporate social responsibility, human resources, recruitment, employee growth and development, compensation and benefits, and legal functions at large public companies in the media industry. In addition, her understanding of consumer behavior based on her knowledge of viewership patterns and preferences provides additional perspective to our Board in understanding our customer base.

Table of Contents